A Core Charge is added to a part that the customer pays for as a type of deposit. This deposit may need to be refunded to the Customer at a later date

An example of a Core Charge is Propane Tanks.

- The Customer would pay a Core Charge ie $25.00 as the deposit for the Propane Tank

- The Customer would then be charged for the gas each time the Customer brings the Propane Tank in to get refilled

- If / When the Customer returns the Propane Tank, the Customer would be refunded the Core Charge of $25.00

How to set up a Core Charge

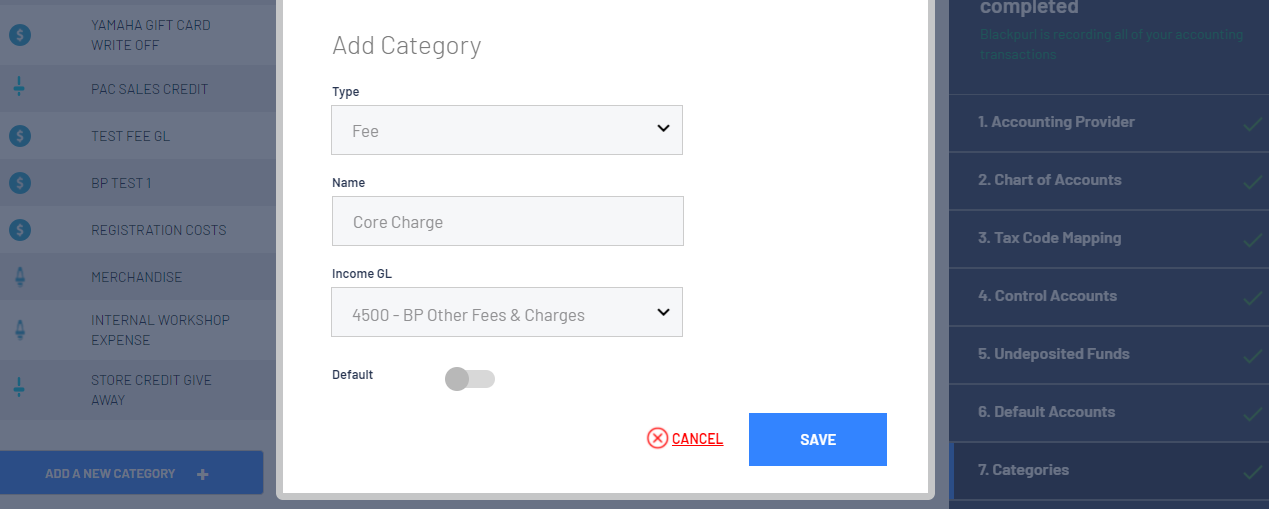

- From the Blackpurl Header > System Settings > Accounting Integration and navigate to the Categories section and then click on

- Complete the relevant Add Category section for the new Category:

Name A quick short name for the new Category ie Core Charge

Then don't forget to SAVE

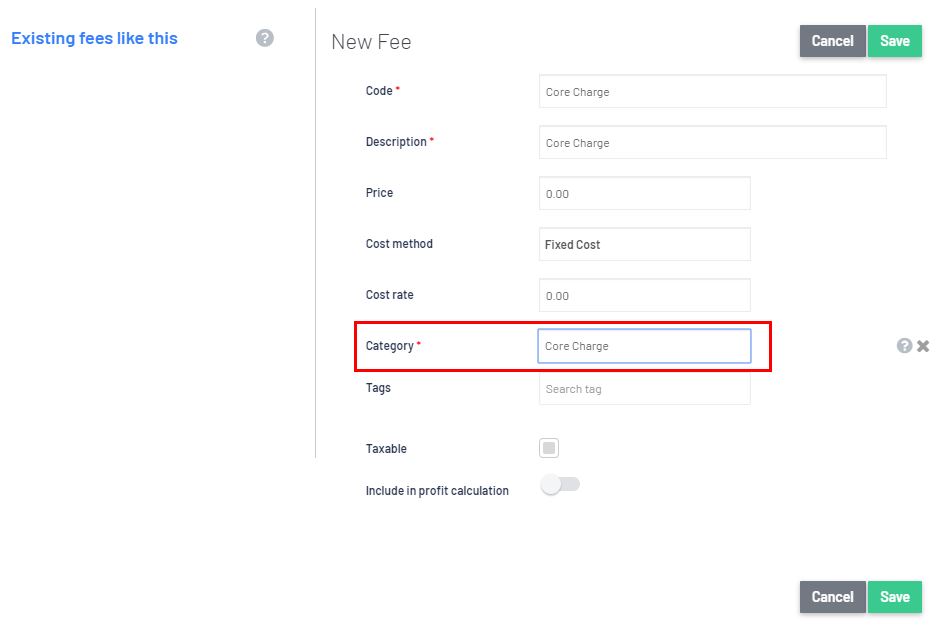

- Create a new Fee called Core Charge

Complete all mandatory fields and also be sure to select the Category created in step 3 and then

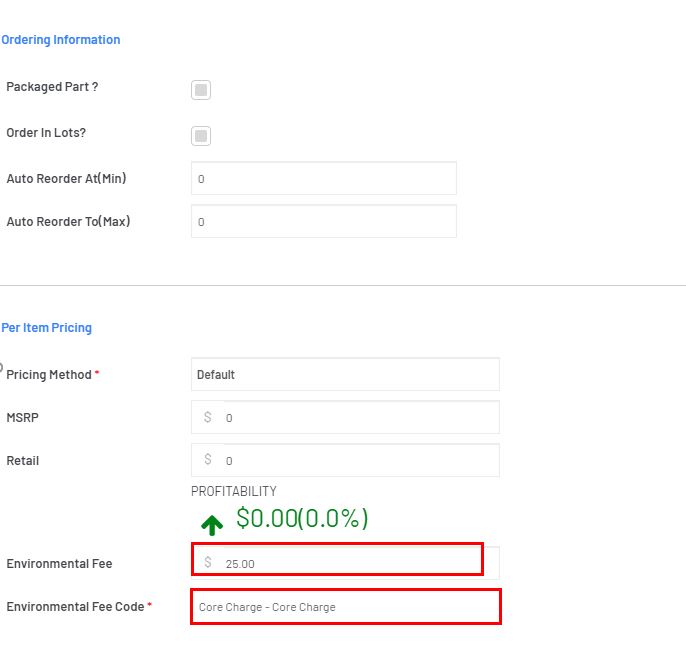

- This FEE for the Core Charge needs to be added directly to the relevant Part

- Navigate to the relevant Part Record > then click on the

- Then scroll down to the per item pricing section > Environment Fee

- Type in the amount of the Core Charge

- Once you start typing the amount of the Core Charge, a new field will pop up for you to complete too - Environment Fee Code

This is where you add your Core Charge FEE

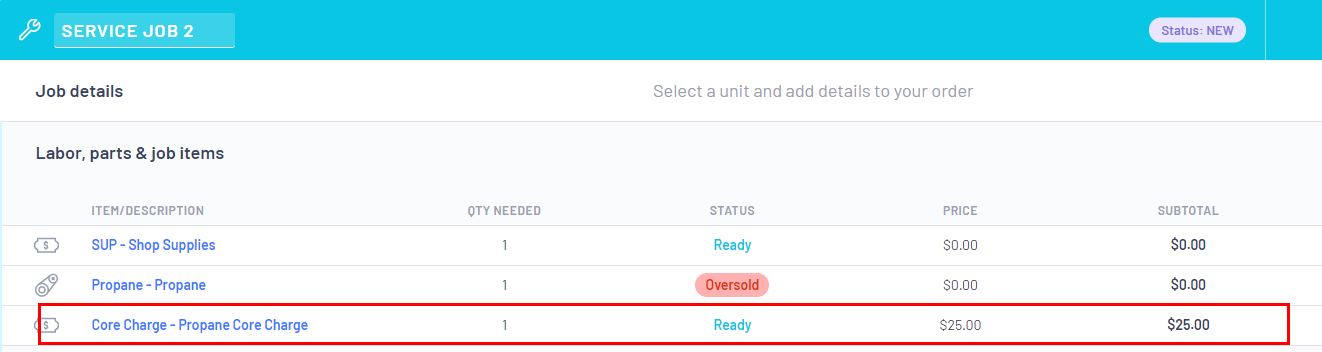

- Result:

Next time you add this Part to a Customer Order it will automatically add the Core Charge as well.

TIP:

- If you do not want to attach the Core Charge to a Part Record > you can simply add the relevant Core Charge FEE to a Customer Order

- When the Customer returns the Item ie Propane Tank, just create a new Customer Order Parts and Accessories and add the Core Charge FEE as a negative quantity.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article