This article will cover how to transfer an outstanding Customer Invoice in QuickBooks Online over to be a Supplier's Credit Note instead

For Warranty Service Jobs, your Warranty Company may elect not to pay the Dealership direct for the warranty work completed

The Warranty Company may instead elected to transfer the Customer Invoice owing to the Dealership for Warranty work to be a Supplier's Credit Note instead

For example:

- Dealership completed a Warranty Service Job for The Unit Company and the Invoice is currently sitting under the QuickBooks Online Customer Record for The Unit Company as outstanding

- The Unit Company are also a Supplier / Vendor and they want to convert anything owing to the Dealership (for Warranty Jobs) to be deducted from what the Dealership owes them as a Supplier / Vendor

However - QuickBooks Online does not have the functionality to just press a button and have the Customer Invoice to now be a Vendor/Suppliers Credit Note so you will need to do a few steps for this process to work:

QuickBooks Online - How to Transferring Customer Invoice over to be a Suppliers Credit Note

- Create a new Chart of Account as a Clearing account

If you already have a clearing account that you use on a regular basis, feel free to use it but just be aware that the QuickBooks Online may need the clearing account to be a certain account type ie Current Asset

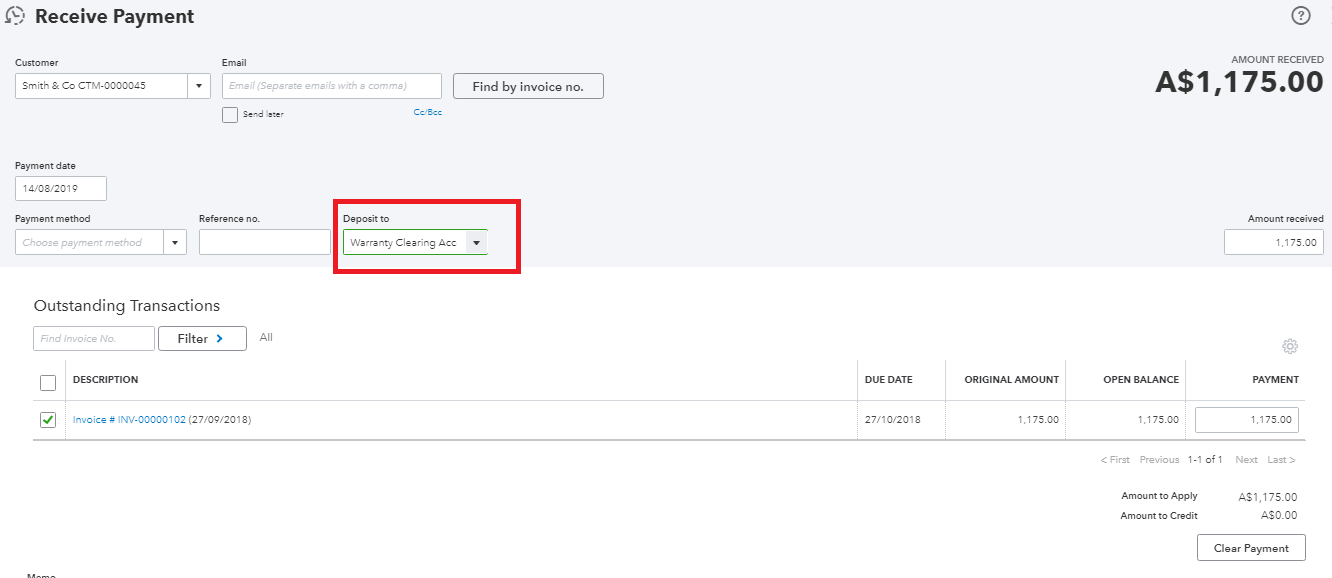

- Pay the relevant Customer Invoice to that Clearing account:

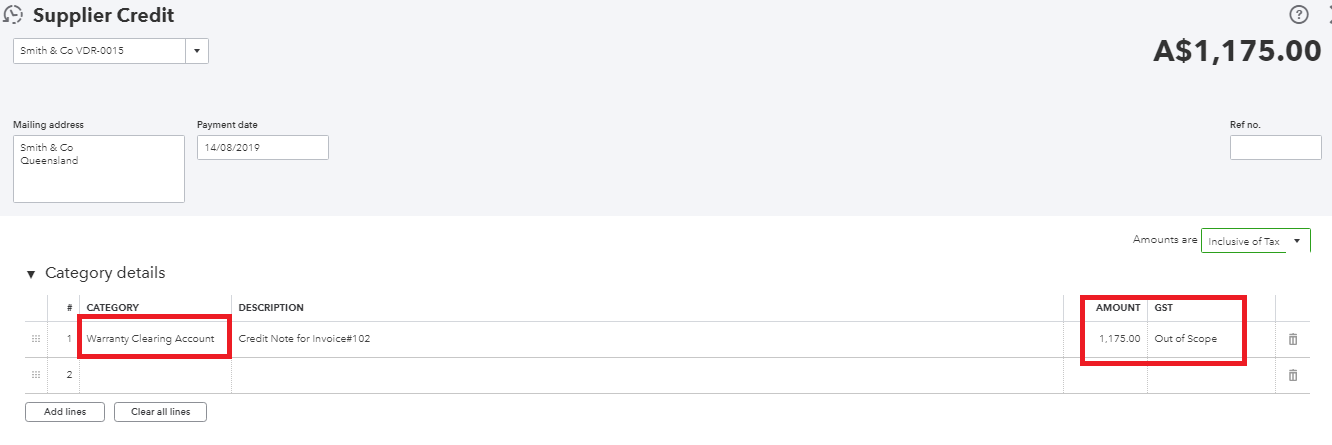

- Then create a Supplier Credit Note to the same Clearing Account:

End Result

- The Customer Invoice has been 'paid' and is no longer sitting on the Customer Record in QuickBooks Online as unpaid

- There is now a Vendor / Suppliers Credit Note sitting on the Vendor / Supplier's Record in QuickBooks Online

- The Clearing account should be zero - this is a good way to check if you have done it correctly

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article